It’s important to understand the information on your pay stub so that you can ensure that you’re getting paid properly. Whether you get a paper check or payment by direct deposit, you receive a pay stub every pay period that explains what you’ve earned as well as any deductions from your pay. This article will provide a brief explanation of the USPS time-keeping system, pay stubs and the USPS ePayroll web application.

Timekeeping

First, let’s discuss timekeeping in the Postal Service. USPS uses a unique timekeeping system that may be unfamiliar to some people when they begin a career with USPS. It is a variation of the military 24-hour clock, but records time in hundredths of an hour rather than in minutes. USPS Notice 30, Time Conversion Table is shown a for letter carriers to use as a reference. Pay stubs and ePayroll statements represent time entries using this timekeeping system. It is important to remember this unique timekeeping system when calculating your hours and payroll.

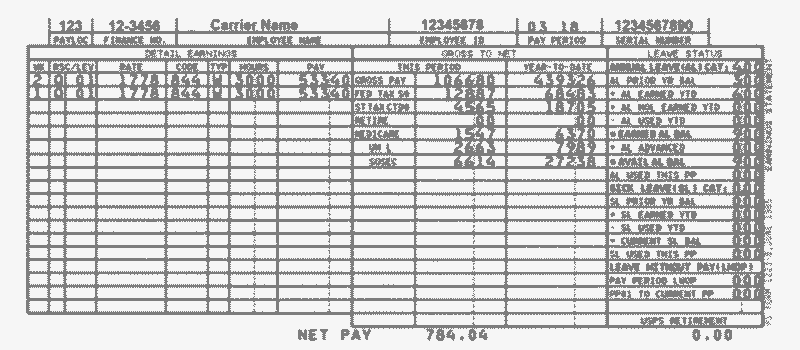

Next, let’s take a look at your pay stub. A sample image of what a traditional pay stub may look like is provided below. At the top of your pay stub are six boxes, which list:

- PAYLOC: Pay Location – This is the number of the work assignment location where you work.

- FINANCE NO: The USPS finance number assigned to your work office.

- EMPLOYEE NAME.

- EMPLOYEE ID: The employee identification number (EIN) assigned to you when you were hired.

- PAY PERIOD: The pay period for this earnings statement (first two digits) and the year of payment (second two digits).

- SERIAL NUMBER: Either the serial number of the check issued to you or the sequence number of the earnings statement issued to you when your net pay has been directly deposited to a financial institution.

Below those boxes, your pay stub is composed of three main sections, titled “Detail Earnings,” “Gross To Net” and “Leave Status.”

DETAIL EARNINGS is a general heading for several entries that tell you the type and number of hours you are being compensated for, the week in which those hours occurred, the rate schedule and level, the designation/activity code, and the gross payment amount for the period. Those entries in this section and the meaning of each entry are as follows:

- WK: Specifies the week, either 1 or 2, of the pay period in which the hours were worked.

- RSC: Stands for Rate Schedule Code for the hours worked. For letter carriers, it will be a “Q.” This code, combined with LEV, is significant and deserves special attention.

- LEV: This is the pay level for the hours worked. Carrier technician duties are indicated as “02” in this column while all other letter carrier work is designated with “01.”

- RATE: Your base rate of pay for the hours worked. For part-time employees, this rate is indicated as an hourly figure, while full-time carriers’ rate is shown as the annual salary. The base rates are printed regularly in The Postal Record, and on the letter carrier pay chart at nalc.org.

- CODE: Your employee designation/activity code. Full-time regular carriers are designated as 13-4, part-time flexible carriers are designated as 43-4, part-time regular carriers are designated as 33-4, and city carrier assistants are designated as 84-4.

- TYP: Pay close attention to this column, which indicates the type of hours you earned. The standard type codes are: W–standard hours; O–overtime, for hours worked past eight in a day or 40 in a week, paid at 1.5 times the regular rate; V–penalty overtime, for hours worked past 10 a day or 56 a week, paid at twice the regular rate; N–night shift differential, for hours worked between 6 p.m. and 6 a.m.; H–holiday pay; L–leave hours taken; and G–guaranteed time, for daily hours guaranteed by USPS but not worked.

- HOURS: This space will show the actual hours and hundredths worked for every hour type listed. If you keep track of your hours worked in the NALC Work Hour Tracker or in a record of your own, you will be able to immediately take steps to correct any errors on your pay stub.

- PAY: This space will show the total gross pay for each type of hours worked. Add up the pay for each category of hours worked and you have your gross pay. Of course, that’s not the final number on your paycheck, since several items will be deducted first. Those items are shown under “GROSS TO NET.”

GROSS TO NET is a general heading for two columns, which show the total gross pay, all deductions, and the resulting net pay for the current pay period (THIS PERIOD) and for your pay year-to-date (YEAR-TO-DATE). Deductions may include taxes withheld, union dues (UN L), payments for health or life insurance, charitable donations you have authorized through the Combined Federal Campaign (CFC), or automatic donations to the NALC’s Letter Carrier Political Fund (LCPF).

At the bottom of the pay stub, NET PAY shows the amount you receive after these deductions.

Under the LEAVE STATUS section, you will see your annual leave (AL) category indicating how many hours of annual leave you earn per pay period. Under this section, you will see your prior AL balance; the AL earned and used this pay period; and your cumulative available AL totals for the year to date. Regular employees have their AL advanced at the beginning of the leave year, which begins with the first full pay period within the calendar year, and it will show in the AL ADVANCED section. Each pay period as AL is earned, it is deducted from advanced and moved to AL EARNED YTD. Also, for career employees, sick leave (SL) earned or used during the pay period as well as the cumulative total are indicated. CCAs do not earn sick leave and will not have any data in the SL section. If you have used leave without pay (LWOP), Wounded Warriors Leave or Donated Leave during the pay period, it will be indicated in this section as well.

ePayroll

Letter carriers also have the option of reviewing their payroll records electronically via the USPS LiteBlue application ePayroll. Next, we will describe ePayroll and how to access the information through LiteBlue.

LiteBlue is a web-based portal specifically designed for USPS employees that can be accessed via liteblue.usps.gov. LiteBlue ePayroll allows employees to review their payroll accounts, allotments and benefits. LiteBlue login requires your EIN and your USPS password. On the LiteBlue home page, you can choose the “Employee Apps – Quick Links – ePayroll” located in the middle of the screen or select the “My HR” tab, then select “Access ePayroll.” You will need to enter your EIN and USPS password again to launch the application.

Your detailed ePayroll information is usually available online, beginning on the Tuesday evening preceding your pay date. Within the ePayroll application are tabs that allow you to view “Employee Information,” “Paid Hours,” “Leave & Retirement Information,” “Additional Pay & Other Compensation,” “Deductions” and “Adjustments.” The adjustments tab details things such as grievance payments or payroll adjustments that posted during the relevant pay period. Keep in mind, the adjustments that appear during the current pay period may be corrections or modifications from previous pay periods. Currently, the ePayroll application allows employees to review and print earnings statements dating back almost two years.

Whether you review a traditional pay stub or the electronic version through ePayroll, it is important for letter carriers to always keep track of their work hours and review their payroll records to make sure that your paycheck has been calculated correctly. If you discover a discrepancy in your payroll, you should speak to your shop steward or branch officer as soon as possible so they can investigate the situation.

This article was originally published in the November 2020 issue of The Postal Record.